The crypto market never sleeps—and neither do its developments. In the past 24 hours alone, major price swings, regulatory moves, and innovative project updates have once again proven that in Web3, every day brings a fresh narrative. Whether you’re a long-term HODLer, a DeFi degenerate, or a cautious observer, staying on top of these rapid changes is key to navigating the crypto ecosystem intelligently.

Here’s your comprehensive 24-hour roundup, covering market movements, global policy updates, and notable project news you can’t afford to miss.

🔹 Price Action: Bitcoin Tests Resistance, Ethereum Holds Strong, Altcoins Wake Up

📉 Bitcoin (BTC): Testing the $59,000 Ceiling

In the past 24 hours, Bitcoin has attempted to break through the $59,000 resistance zone, but faced stiff selling pressure. After a short-lived rally earlier in the day triggered by favorable ETF speculation, BTC saw a minor correction and now hovers around $57,800.

- Short-term sentiment remains cautious, especially with lower trading volumes across major exchanges.

- On-chain data shows a slight uptick in whale activity, suggesting accumulation at current price levels.

Key takeaway: BTC dominance remains above 51%, but the inability to sustain gains above $59K hints at a consolidative phase ahead of key macroeconomic data releases.

🔷 Ethereum (ETH): Steady Amid Scalability Buzz

Ethereum remains relatively stable, trading around $3,450, despite heightened chatter surrounding its upcoming Proto-Danksharding (EIP-4844) integration expected later this year. The anticipation of significantly lower Layer 2 gas fees is keeping ETH on traders’ radars.

- Staking participation remains strong, with 32.1 million ETH currently locked.

- The ETH/BTC pair is showing resilience, indicating Ethereum’s strength relative to Bitcoin during this sideways market.

Insight: As Ethereum’s scaling roadmap progresses, investor confidence in its long-term utility and fee reduction potential is growing.

🚀 Altcoins: Selective Surges in AI & DePIN Sectors

A few altcoins bucked the trend with double-digit gains:

- Render (RNDR) jumped 12% amid growing demand for decentralized GPU rendering in AI applications.

- Fetch.ai (FET) and Ocean Protocol (OCEAN) also surged following news of their merger under the Artificial Superintelligence Alliance.

- Helium (HNT) gained 9% on expanding DePIN integrations with Solana-based IoT services.

Meanwhile, meme coins saw a cooldown after recent rallies, with DOGE and PEPE both slipping 3–5%.

Market pulse: Capital rotation is favoring infrastructure-focused tokens, especially those tapping into AI, DePIN, and RWAs.

🔹 Policy and Regulation: Legal Clarity or More Confusion?

🇺🇸 United States: Regulatory Winds Shift Slightly in Favor of Crypto

In a surprise move, a bipartisan group of U.S. senators introduced the Crypto Clarity Act, aiming to clearly define the classification of digital assets and protect decentralized protocols from being treated as centralized entities.

- The bill distinguishes between protocol developers, validators, and centralized operators, shielding open-source contributors from legal liability.

- The crypto community has largely welcomed the draft, although critics argue it leaves too much discretion to the SEC.

In parallel, rumors persist that the SEC may approve a spot Ethereum ETF by year-end, further fueling institutional optimism.

Key takeaway: The U.S. policy narrative is slowly shifting from enforcement to engagement—though the waters remain murky.

🇪🇺 Europe: MiCA Phase-In Period Begins

The Markets in Crypto Assets (MiCA) regulation is now officially in its phase-in period, requiring exchanges and custodians in the EU to begin registering and complying with new transparency rules.

- This includes stablecoin reserve disclosures and AML (Anti-Money Laundering) compliance frameworks.

- Binance and Kraken have already announced MiCA readiness, while smaller exchanges are scrambling to adjust.

Impact: MiCA is setting the tone for clear, continent-wide regulation—something other regions may soon follow.

🌏 Asia: Vietnam and South Korea Make Headlines

Vietnam’s Ministry of Finance has confirmed that it is preparing a draft legal framework for digital assets, focusing on licensing requirements for crypto exchanges and custody services. This move could formalize Vietnam’s position as a rising crypto hub.

Meanwhile, South Korea’s FSC (Financial Services Commission) has begun investigating token listings on domestic exchanges for signs of price manipulation and insider trading, tightening compliance further in an already-regulated environment.

Regional trend: Asian regulators are leaning toward structured compliance, balancing innovation and investor protection.

🔹 Projects and Ecosystems: What Builders Are Shipping

The past 24 hours also brought fresh updates from several major crypto projects—some building for scalability, others for new real-world use cases.

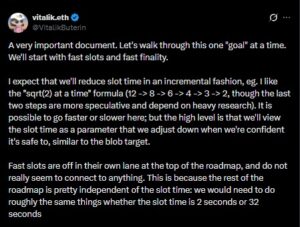

⚙️ Ethereum Ecosystem: EIP-4844 Testnet Gains Momentum

The Ethereum Foundation confirmed that Devnet 13 for Proto-Danksharding (EIP-4844) has achieved stable transaction throughput with “blob” data working as intended. This testnet milestone is crucial for the next phase of Ethereum scaling.

- Rollup providers like Optimism, Arbitrum, and Base have announced readiness to integrate blob support once mainnet is live.

- Gas costs on testnet rollups have dropped by up to 90%, validating Ethereum’s scaling thesis.

Builder insight: This isn’t just a technical win—it’s a step toward onboarding the next billion users.

🧠 AI Meets Blockchain: ASI Alliance Makes First Strategic Move

The newly formed Artificial Superintelligence Alliance (ASI)—a merger of Fetch.ai, Ocean Protocol, and SingularityNET—released a joint roadmap outlining interoperable AI agents, decentralized data sharing, and compute layer innovations.

- A combined token model and cross-chain functionality are scheduled for Q4 2025.

- The alliance has already caught the attention of major VC firms and enterprise partners.

Narrative forming: AI x blockchain isn’t just a buzzword—it’s becoming a coordinated industry initiative.

🌿 Real-World Assets: MakerDAO Expands RWA Portfolio

MakerDAO, the protocol behind DAI, has voted to increase its exposure to real-world assets by allocating an additional $300 million into tokenized U.S. Treasuries and short-term bonds.

- The strategy aims to boost protocol revenue through low-risk yield generation.

- The RWA category in DeFi is now the fastest-growing, surpassing $5 billion in combined TVL across protocols.

DeFi trend: Tokenizing real-world assets is proving to be one of the most tangible bridges between TradFi and DeFi.

🔹 Final Thoughts: The Clock Never Stops in Crypto

If the past 24 hours are any indication, crypto remains an ecosystem of relentless energy, creative innovation, and ongoing regulatory drama. Price movements are just the surface; beneath them lie structural shifts in governance, scalability, adoption, and policy.

From Ethereum’s testnet breakthroughs to policy progress in the U.S. and EU, and from rising altcoins in AI to DeFi’s evolution through RWAs, the narrative is clear: crypto isn’t slowing down—it’s gearing up.

Stay tuned with EthereumVietnamNews.com and our Crypto News category for your next 24-hour snapshot of everything that matters in the world of digital assets.