In the rapidly evolving world of blockchain technology, Ethereum continues to be a dominant force shaping the decentralized future. As the backbone of smart contracts, DeFi, and countless dApps, Ethereum’s every move reverberates across the crypto ecosystem. From pivotal protocol upgrades to shifting regulatory dynamics, this Ethereum News Roundup brings you the most important global developments you need to stay ahead.

🔹 The Merge Aftermath: What’s Next for Ethereum’s Roadmap?

Since Ethereum’s historic transition from Proof of Work (PoW) to Proof of Stake (PoS) through The Merge, the network has seen improved energy efficiency and enhanced scalability preparations. The post-Merge roadmap has entered a new phase: The Surge, focused on rollup scaling via Danksharding and Proto-Danksharding (EIP-4844).

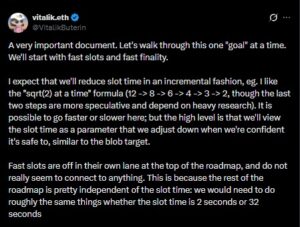

The Dencun Upgrade, initially scheduled for late 2024 but now eyed for Q4 2025, introduces blob transactions, a major step toward reducing Layer-2 fees. This upgrade is poised to improve Ethereum’s data availability model, providing a foundation for cheaper and faster rollups. If successful, it will drastically improve transaction throughput—an essential step in Ethereum’s journey to mass adoption.

🔹 Layer 2 Ecosystem: Arbitrum, Optimism, Base, and Beyond

As Ethereum’s base layer prioritizes security and decentralization, Layer 2 solutions are taking center stage in solving the scalability puzzle. Networks like Arbitrum and Optimism have seen explosive growth, with TVL (Total Value Locked) across Layer 2s reaching over $30 billion in mid-2025.

Coinbase-backed Base is gaining momentum by integrating seamlessly with Coinbase’s massive user base, accelerating onboarding into the Ethereum ecosystem. Meanwhile, zk-rollup solutions like zkSync Era and Starknet continue to push the envelope in terms of privacy, speed, and efficiency.

Key Insight: The Layer 2 wars are no longer just about speed and cost—they’re about ecosystems, developer tools, and user experience.

🔹 Institutional Adoption: Ethereum Finds Favor in Finance

The institutional embrace of Ethereum is no longer hypothetical—it’s happening in real time. From traditional finance giants to Web2 tech behemoths, Ethereum is at the heart of the tokenization movement.

- BlackRock, J.P. Morgan, and Goldman Sachs have all piloted tokenized assets and bonds using Ethereum-based infrastructure.

- The European Investment Bank (EIB) recently issued its third round of digital bonds on Ethereum.

- HSBC announced a strategic partnership to bring tokenized real-world assets (RWAs) to Ethereum-compatible platforms.

Tokenization of real estate, bonds, and carbon credits is emerging as one of the most viable use cases for Ethereum in institutional finance.

🔹 ETH Price Movements and Market Trends

Ethereum (ETH) has remained resilient amid global macroeconomic pressures, fluctuating around the $3,200 to $3,700 range in Q3 2025. The recent bounce from regulatory clarity in key jurisdictions such as the U.S., EU, and South Korea has added a layer of investor confidence.

Ethereum’s staking economy has also reached new highs. According to on-chain data:

- Over 32 million ETH (roughly 26% of total supply) is now staked.

- The average staking yield has stabilized around 3.5%–4.2% APR.

Meanwhile, ETF buzz continues. While the SEC has yet to approve a spot ETH ETF in the U.S., Canada, Germany, and Hong Kong have all launched Ethereum ETFs, signaling a growing appetite for Ethereum exposure in traditional markets.

🔹 Global Regulation: Ethereum’s Legal Landscape Shifts

Ethereum’s evolving regulatory status remains a crucial theme globally. In the United States, the SEC appears to be slowly shifting its stance. After years of regulatory ambiguity, there’s a growing belief that ETH will not be classified as a security, especially following the recent Hinman document revelations and ongoing Ripple court outcomes.

In Asia, the narrative is mixed:

- Japan continues to foster Ethereum innovation, with the FSA pushing forward with crypto-friendly sandbox regulations.

- Vietnam and Singapore remain hotbeds of Ethereum-based DeFi development, with an increasing number of startups building on Ethereum-compatible chains.

- China, despite its domestic crypto ban, continues to explore Ethereum-compatible blockchains through its BSN (Blockchain-based Service Network) for international use.

In Europe, the MiCA (Markets in Crypto Assets) framework provides clear definitions and guidelines for ETH and Ethereum-based assets, giving European startups a much-needed compliance path.

🔹 Real-World Use Cases: From NFTs to RWAs

NFTs on Ethereum have matured from speculative collectibles to real-world utility. Projects are moving beyond hype into areas like:

- Music Rights (e.g., Sound.xyz, Royal.io)

- Gaming Assets (via Immutable and others)

- Identity and Credentials (via Soulbound Tokens)

Ethereum’s ERC standards continue to evolve, with ERC-6551 (token-bound accounts) gaining traction in the NFT space, enabling NFTs to own other assets, including other NFTs and tokens.

Real-world asset tokenization—RWAs—on Ethereum is being accelerated by startups like Centrifuge, Maple Finance, and Goldfinch, bridging the gap between DeFi and TradFi by offering yield-generating opportunities backed by real economic activity.

🔹 Developer Ecosystem: Tooling, Trends, and Talent

Ethereum remains the most developer-rich blockchain ecosystem:

- Over 20,000 active monthly developers are contributing to Ethereum and its ecosystem tools.

- The dominance of frameworks like Hardhat, Foundry, and ethers.js reflect Ethereum’s deep maturity in tooling.

- Programming trends are shifting toward Account Abstraction (ERC-4337), modular smart contract design, and zero-knowledge proofs.

Hackathons, developer bootcamps, and L2 grants are helping onboard the next generation of builders. Ethereum’s global community is stronger than ever, with events like ETHGlobal, Devcon, and ETHVietnam fostering cross-border collaboration.

🔹 What to Watch Next

As we look ahead to the final quarter of 2025, Ethereum’s trajectory remains tightly intertwined with both macroeconomic trends and technological breakthroughs. Key developments to keep an eye on include:

- The official launch and integration of Proto-Danksharding (EIP-4844)

- Progress in decentralized identity standards (DID)

- Continued expansion of staking liquidity solutions

- Regulatory developments surrounding spot ETH ETFs

- Growth in Ethereum-based gaming and metaverse ecosystems

Final Thoughts: Ethereum’s Global Pulse Remains Strong

Ethereum continues to stand as a pillar of innovation, adaptability, and community-driven growth. Whether you’re a developer, investor, policy watcher, or DeFi user, Ethereum’s pace of change demands close attention. From the sidewalks of Ho Chi Minh City to the financial hubs of London and New York, Ethereum is more than a blockchain—it’s a global movement.

Stay tuned with EthereumVietnamNews.com as we continue to track the pulse of Ethereum across borders, cultures, and industries.