In the ever-evolving world of cryptocurrency, some headlines shape the future while others simply fade away. With market sentiment shifting by the hour and technological breakthroughs unfolding rapidly, it’s essential to separate the signal from the noise.

In this edition of Crypto in Focus, we spotlight the stories that are defining the moment—across market dynamics, regulation, innovation, and adoption. Whether you’re a crypto veteran, a cautious investor, or a curious newcomer, here’s what truly matters right now in the world of digital assets.

🔹 1. Ethereum’s Next Big Leap: Proto-Danksharding Nears Launch

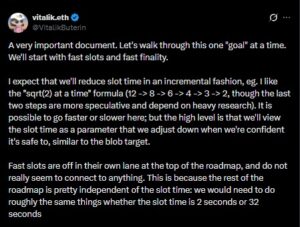

Ethereum’s scaling journey is inching closer to its next milestone. After the successful Merge and subsequent Shapella upgrade, all eyes are now on Proto-Danksharding (EIP-4844), scheduled for mainnet release later this year.

Why it matters:

EIP-4844 introduces “blobs” — a new type of transaction data — dramatically lowering Layer 2 fees and improving network efficiency. It’s expected to significantly reduce costs for rollups like Arbitrum, Optimism, zkSync, and Base, helping Ethereum compete with high-speed alternative chains.

“Proto-Danksharding could be the single most impactful upgrade for end-users since the Merge,” says Ethereum Foundation researcher Dankrad Feist.

The upgrade’s recent success on Devnet 13 shows strong progress toward public testnets. Builders, investors, and users should be watching this one closely.

🔹 2. Bitcoin’s Battle with $60K: Bull Run or Trap?

Bitcoin (BTC) continues to flirt with the $60,000 level but remains volatile amid macroeconomic uncertainty. In the past week, BTC has swung between $56,500 and $59,800, mirroring global risk sentiment ahead of key inflation data from the U.S.

- Institutional inflows into spot Bitcoin ETFs have slowed slightly, leading analysts to speculate whether BTC is entering a consolidation phase.

- Hashrate remains at historic highs, reflecting miner confidence despite pressure on profitability post-halving.

Zoom out: Bitcoin is still up over 110% year-over-year. But the market’s next leg may depend on either a surprise catalyst—such as an Ethereum ETF approval—or a shakeout event.

🔹 3. Regulation Watch: SEC, MiCA, and Asia’s Dual Approach

Crypto regulation remains a hot-button issue worldwide, and the past few days have been especially revealing.

🇺🇸 United States:

The U.S. SEC is reportedly reviewing feedback on its proposed redefinition of “exchange,” which critics argue could encompass decentralized platforms and automated market makers. Meanwhile, Ethereum ETF approval discussions are gaining traction, with multiple fund issuers updating their S-1 filings in anticipation of a final decision by late 2025.

“There’s more political pressure than ever for the SEC to define, not just enforce,” says crypto policy analyst Kristin Smith.

🇪🇺 Europe:

Europe’s Markets in Crypto Assets (MiCA) framework is beginning to show results. Major exchanges like Kraken, Bitstamp, and Binance have published MiCA compliance reports, ensuring transparency around reserves, token listings, and customer protection.

🌏 Asia:

- Singapore is advancing tokenization use cases in its Project Guardian initiative, partnering with institutions to launch tokenized assets on regulated blockchains.

- Vietnam has drafted initial guidelines for crypto exchanges and wallets under its fintech sandbox. While still early, it signals a shift toward formal recognition of digital assets.

Why it matters:

A patchwork of global regulations is slowly becoming a mosaic. For crypto to grow sustainably, policy clarity must catch up with innovation.

🔹 4. Altcoins: Not All Are Created Equal

While Bitcoin and Ethereum dominate headlines, altcoins continue to jockey for attention—and capital. But the days of indiscriminate pumps are over. The market is growing more selective.

Gaining Ground:

- Chainlink (LINK) surged after its CCIP (Cross-Chain Interoperability Protocol) gained traction with institutional partners.

- Render (RNDR) and The Graph (GRT) are riding the AI infrastructure narrative, with growing integrations across decentralized AI protocols.

- MakerDAO (MKR) continues to dominate the RWA narrative, with over $3 billion now in tokenized treasury exposure.

Slipping Behind:

- Meme coins like PEPE and BONK saw double-digit losses as trading volumes cooled.

- Layer 1s such as Avalanche (AVAX) and Algorand (ALGO) are losing market share to Ethereum Layer 2s.

Takeaway:

The market is maturing. Fundamentals, user growth, and real-world use cases are beginning to drive value—over hype and speculation.

🔹 5. Real-World Assets (RWAs): The Next DeFi Boom?

DeFi isn’t dead—it’s evolving. The next frontier? Real-World Assets.

Protocols like Ondo Finance, Maple, and Goldfinch are bridging the gap between traditional finance and DeFi by offering tokenized versions of bonds, real estate, invoices, and even carbon credits.

- BlackRock recently issued tokenized Treasuries on Ethereum.

- MakerDAO now allocates a significant portion of its reserves to U.S. Treasury bonds.

- Circle is exploring RWA support for USDC collateralization.

“RWAs are reshaping DeFi into something regulators can understand and institutions can adopt,” says DeFi researcher Alex Krüger.

The blending of yield, security, and transparency is turning RWAs into the hottest trend of late 2025—and Ethereum is once again at the center of it.

🔹 6. The AI & Crypto Collision Is Getting Real

The convergence of artificial intelligence and blockchain is no longer just theoretical. Projects in both spaces are beginning to cooperate in ways that could reshape both industries.

- The Artificial Superintelligence Alliance (ASI)—a merger of Fetch.ai, SingularityNET, and Ocean Protocol—is creating a unified token and roadmap.

- Bittensor (TAO) and Numeraire (NMR) continue to attract interest from developers building decentralized AI models.

The use of blockchain to verify, train, and monetize AI models is seen as a counter to centralized AI hegemony dominated by Big Tech.

Look ahead: AI x Crypto may define the next 5 years of innovation. Pay attention to infrastructure tokens, data marketplaces, and compute layer projects.

🔹 Final Thoughts: Focus on What Moves the Needle

The crypto industry is no stranger to noise—but understanding what truly matters helps cut through it. Ethereum’s scaling roadmap, Bitcoin’s resilience, regulatory developments, altcoin utility, and emerging sectors like RWAs and AI integration are all key narratives shaping the future.

Crypto isn’t just speculative anymore—it’s strategic.

And in this moment of transformation, the projects, protocols, and policies making headlines today are building the foundation for the decentralized world of tomorrow.

Stay informed. Stay ahead. Stay focused.

For more timely updates and expert analysis, keep reading EthereumVietnamNews.com’s Crypto News section.