In the span of just over a decade, blockchain technology has evolved from a niche curiosity to a foundational force reshaping industries. While initially associated solely with cryptocurrencies like Bitcoin and Ethereum, the landscape today is vastly more intricate and expansive. Governments, multinational corporations, startups, and even NGOs are investing heavily in blockchain—not just for its novelty, but for its real-world utility.

So, what exactly is fueling this momentum? Let’s unpack the key drivers propelling blockchain development today.

1. Institutional Adoption: Beyond the Pilot Stage

One of the most significant forces pushing blockchain development is institutional adoption. Enterprises have moved past the “proof of concept” phase and are now deploying blockchain solutions in live environments.

- Finance & Banking: JPMorgan’s Onyx platform, HSBC’s blockchain bond issuance, and Deutsche Bank’s tokenization efforts reflect the sector’s shift from testing to implementation.

- Supply Chain: IBM’s Food Trust and Maersk’s TradeLens are real-world examples where blockchain enhances traceability, efficiency, and trust.

These developments validate blockchain’s value proposition—decentralization, immutability, and transparency—and are pushing others to follow suit.

2. Government Initiatives & Regulation

Contrary to the early perception that governments would stifle blockchain innovation, regulatory clarity in several regions is now fostering confidence.

- Europe’s MiCA (Markets in Crypto-Assets) regulation sets a precedent for balanced governance.

- China’s BSN (Blockchain Service Network), despite banning cryptocurrencies, actively promotes blockchain for data management and digital infrastructure.

- The UAE, Singapore, and Estonia continue to lead in government blockchain applications, from land registries to digital identities.

Governments are now key stakeholders in blockchain’s future, and their investment in digital infrastructure is a strong development signal.

3. Tokenization of Real-World Assets (RWA)

The next frontier for blockchain is tokenization—converting physical or traditional financial assets into digital tokens.

- Tokenized real estate, art, commodities, and even carbon credits are gaining traction.

- BlackRock, Franklin Templeton, and other financial giants have publicly embraced the idea of blockchain-powered financial instruments.

By unlocking liquidity and enabling fractional ownership, tokenization could revolutionize how assets are bought, sold, and traded globally.

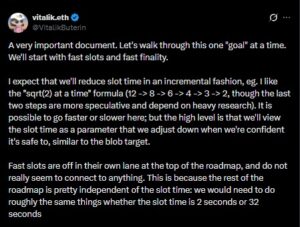

4. Interoperability and Layer 2 Scaling Solutions

Scalability and compatibility have long plagued blockchain networks, but current innovation is addressing these issues head-on.

- Layer 2 solutions like Arbitrum, Optimism, and zkSync are helping Ethereum scale without compromising security or decentralization.

- Cross-chain protocols such as Polkadot, Cosmos, and Chainlink’s CCIP are making it easier for different blockchains to communicate and share data.

These advancements enhance blockchain’s usability and open doors to multi-chain ecosystems—vital for mainstream adoption.

5. Web3 and the Rise of Decentralized Identity

As Web3 evolves, blockchain is becoming the underlying fabric for decentralized identity (DID), data ownership, and user empowerment.

- Projects like ENS (Ethereum Name Service) and Worldcoin (controversial but ambitious) are reimagining how we manage our digital presence.

- DID can enable borderless access to services, especially in underserved regions, and redefine access to healthcare, education, and finance.

Blockchain’s alignment with user-centric digital experiences is a major tailwind for continued development.

6. Environmental, Social & Governance (ESG) Integration

Blockchain’s role in supporting ESG initiatives is rapidly growing. Contrary to early criticisms about energy usage, especially with Bitcoin, the narrative is shifting.

- Ethereum’s shift to Proof of Stake (PoS) cut its energy use by over 99%.

- ESG-focused platforms like Toucan Protocol and Regen Network are bringing carbon offsetting and sustainability efforts on-chain.

- Transparent ledgers help verify ethical sourcing and environmental compliance across supply chains.

As investors and governments prioritize sustainability, blockchain’s transparency becomes an essential tool.

7. Developer Ecosystem & Open-Source Momentum

No technology thrives without a vibrant developer community—and blockchain has one of the most engaged ecosystems in tech.

- Ethereum, Solana, and Polkadot boast active developer communities building DeFi, NFTs, DAOs, and infrastructure protocols.

- Hackathons, grants, and community funding (via DAOs) provide fertile ground for experimentation and innovation.

This open-source ethos accelerates development, encourages collaboration, and democratizes access to cutting-edge technology.

8. Geopolitical and Economic Pressures

In a world rife with geopolitical uncertainty, currency instability, and financial censorship, blockchain emerges as a tool for autonomy.

- Citizens in inflation-hit countries like Venezuela, Argentina, and Turkey are turning to crypto-based solutions for stability.

- Blockchain enables peer-to-peer transactions, remittances, and store-of-value options outside the traditional system.

These macroeconomic factors are powerful motivators for further blockchain development, particularly in emerging markets.

9. AI and Blockchain Convergence

Another key driver is the synergy between AI and blockchain. While AI handles computation and prediction, blockchain ensures data provenance, transparency, and decentralized access.

- Projects are exploring AI training on decentralized data, on-chain model verification, and autonomous agents in DeFi protocols.

- This convergence could reshape industries like healthcare, cybersecurity, and logistics.

The fusion of these two technologies signals the next wave of intelligent, trustless systems.

Final Thoughts: Evolution, Not Hype

Blockchain is no longer a buzzword. It’s becoming the backbone of a new digital economy—one that prioritizes transparency, decentralization, and efficiency. From finance to food supply, from identity to infrastructure, the building blocks of tomorrow are being laid today.

As the technology matures, driven by both idealism and pragmatism, its role will only deepen. For builders, regulators, and users alike, the message is clear: blockchain is here, and it’s evolving—fast.

Whether you’re an investor tracking the next big use case, a developer seeking real-world impact, or a policymaker shaping digital futures—understanding the forces driving blockchain development today is essential. The chain keeps growing. Are you keeping up?