Is crypto losing steam, or is it simply evolving? This question has gained momentum in recent months as trading volumes across major cryptocurrency exchanges have taken a noticeable dip. Headlines scream of a liquidity crunch, crypto skeptics call it a fading fad, while others argue it’s a sign of market maturity. So, which is it?

Let’s peel back the layers and analyze whether declining trading volumes reflect a temporary bottleneck or a structural transformation in the global crypto ecosystem.

A Snapshot: Falling Volumes Across the Board

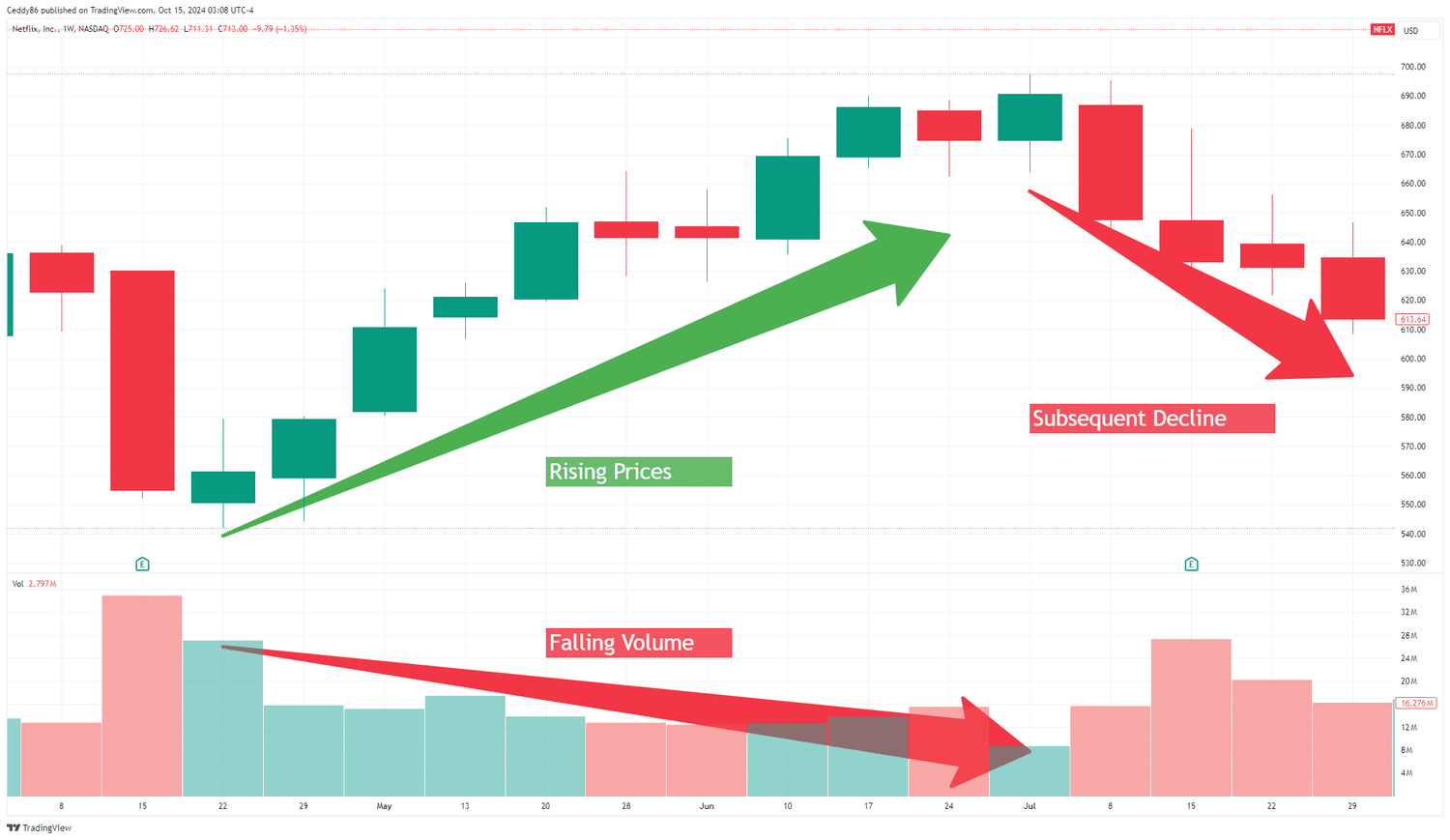

The once-roaring crypto markets that saw record-breaking volumes during the bull runs of 2017 and 2021 are now relatively subdued. According to data from CoinGecko and The Block, spot trading volumes on major exchanges like Binance, Coinbase, Kraken, and OKX have seen a 40–60% year-over-year decline in 2024–2025.

Binance, the industry’s largest exchange, saw its monthly spot trading volume fall from over $500 billion in early 2021 to under $150 billion in recent months. Even derivatives markets, typically more resilient, have shown signs of softening. But is this drop a result of diminishing demand, or is something else at play?

Understanding Liquidity: More Than Just Volume

Before jumping to conclusions, it’s essential to differentiate between liquidity and volume. Trading volume measures how much is being bought and sold — but liquidity refers to how easily assets can be traded without affecting their price.

An exchange can have lower volumes yet remain liquid if it maintains tight spreads and deep order books. Conversely, high volumes in thinly traded assets can mask liquidity risks.

In essence, volume is the pulse — liquidity is the blood flow. And when both start slowing, the body starts feeling it.

The Case for a Liquidity Crunch

Several indicators support the idea that crypto markets are experiencing a liquidity crunch:

1. Regulatory Uncertainty Is Scaring Off Market Makers

2024 and 2025 have seen a wave of regulatory crackdowns across the globe — from the SEC’s persistent lawsuits in the U.S. to tightening AML and KYC frameworks in Europe and Asia. As a result, many market makers and institutional players have scaled back operations, especially in jurisdictions where compliance clarity is lacking.

This retreat has thinned order books, widened spreads, and reduced overall depth, making it riskier and costlier to trade, particularly for larger players.

2. Retail Interest Has Waned

Retail traders, once the driving force behind massive run-ups in coins like Dogecoin, Shiba Inu, and Solana, are now far less active. Data from Google Trends, Reddit, and wallet downloads reflect a significant decline in retail engagement since the last bull cycle.

Fewer participants mean lower volumes — and lower volumes mean diminished liquidity, especially in smaller-cap tokens.

3. On-Chain Activity Has Shifted

Interestingly, while exchange volumes are down, on-chain metrics for certain blockchains like Ethereum and Solana have remained relatively steady — albeit with a shift toward DeFi protocols, staking, and real-world asset tokenization.

This suggests that some liquidity is migrating off centralized exchanges and into decentralized ecosystems, creating fragmentation and reducing the visible depth of traditional order books.

The Maturity Argument: Evolution, Not Decline?

On the other side of the debate are analysts who argue that what we’re witnessing isn’t a crisis, but a coming of age for the crypto markets.

1. From Speculation to Utility

The crypto ecosystem is slowly transitioning from being speculation-driven to utility-driven. Fewer traders chasing volatile price action doesn’t necessarily indicate weakness — it could simply mean the market is no longer driven by hype.

In fact, many leading projects are now focusing on real-world integrations, infrastructure, payments, and enterprise use cases — not meme coin pumps.

2. Smart Money, Not Fast Money

Institutional investors have entered cautiously but strategically. Rather than chasing daily trades, they’re now taking longer-term positions in Bitcoin ETFs, tokenized treasuries, and staking-based assets. This shift to long-hold strategies naturally reduces churn and daily volumes, but reflects confidence in the asset class, not fear.

Bitcoin ETF inflows, for example, show billions in net deposits, despite spot market volumes declining. The key? Institutions are playing a different game — one measured in years, not hours.

3. Consolidation of Exchanges and Assets

The rise and fall of smaller exchanges, as well as the collapse of outliers like FTX, has led to consolidation in both venues and asset preferences. Traders are now concentrated around a few major exchanges and a handful of blue-chip tokens, reducing the chaos of previous cycles.

This streamlining has reduced speculative froth while creating more stable but lower-volume markets.

Key Metrics to Watch

To truly assess whether this is a crunch or a maturing process, here are the metrics analysts are watching closely:

- Order Book Depth: Are buy/sell walls thinning?

- Bid-Ask Spreads: Are trading costs increasing?

- On-Chain Liquidity Pools: Is DeFi absorbing centralized volume?

- Token Velocity: How often are assets changing hands?

- Volatility Indexes: Are we seeing calmer markets due to stability or stagnation?

A decrease in raw volume paired with steady order book depth and tighter spreads may suggest healthy maturity. But if all indicators shrink together, a deeper liquidity crunch could be unfolding.

What This Means for Traders and Investors

If you’re a retail investor, this shift means one thing: adapt or get left behind. Gone are the days of easy 10x returns on obscure tokens. Strategies now demand more research, longer horizons, and risk-adjusted thinking.

For institutions, the maturing landscape offers a safer, more predictable environment, especially as regulatory clarity improves and ETFs continue to bridge TradFi with crypto.

And for builders and exchanges, the future will be shaped by one goal: attracting and sustaining meaningful liquidity — not just chasing volume spikes.

Final Thoughts: A Fork in the Road

So, are we facing a liquidity crunch or witnessing market maturity? The answer isn’t binary — it’s likely a mix of both.

Yes, trading volumes are down. Yes, retail enthusiasm has cooled. But these trends can coexist with institutional adoption, on-chain migration, and a shift toward utility-driven models.

Like all emerging markets, crypto is navigating growing pains. But one thing is clear: the days of unregulated, unsustainable trading frenzies are fading. In their place, a leaner, more resilient market is taking shape — one where volume may be lower, but purpose runs deeper.

Bottom line? Don’t mistake silence for stagnation. In crypto, quiet markets often precede major shifts — and the smart money knows it.